New Delhi: Bharti Infratel has agreed to merge with Indus Towers in a deal that will create the largest mobile tower operator in the world outside China with over 163,000 towers across 22 telecom service areas and an estimated equity value of $14.6 billion.

Seeking to capitalise on the rapid growth in smartphone use in the country, the transaction, which values Indus Towers at roughly $10.8 billion, will create an infrastructure giant that will lag only China Tower.

Bharti Airtel, the majority owner of Bharti Infratel, will be the biggest shareholder in the combined company followed by Vodafone Group. The two other main shareholders of Indus – Idea Cellular and Providence Equity Partners – will have an option to cash out.

“The combined company, which will fully own the respective businesses of Bharti Infratel and Indus Towers, will change its name to Indus Towers Limited and will continue to be listed on the Indian stock exchanges,” Bharti Group said in a statement announcing the joint deal on Wednesday.

Bharti Airtel also said separately it would sound out potential investors with a view to selling stakes in the combined entity.

The combined company will own 100 per cent of Indus Towers, which, at present, is jointly owned by Bharti Infratel (42 per cent), Vodafone (42 per cent), Idea Group (11.15 per cent) and Providence (4.85 per cent).

The deal comes amid a vicious price war in the telecom sector that has helped spur a rush of M&A activity, including a planned merger of Vodafone’s Indian unit and Idea that threatens Bharti Airtel’s position as India’s biggest phone carrier.

Vodafone and Idea had flagged they would look at selling their stakes in Indus and other tower assets they separately own to help cut debt for the merged telecom carrier.

Under the deal, Bharti Infratel will pay 1,565 of its own shares for each Indus Towers share, the companies said.

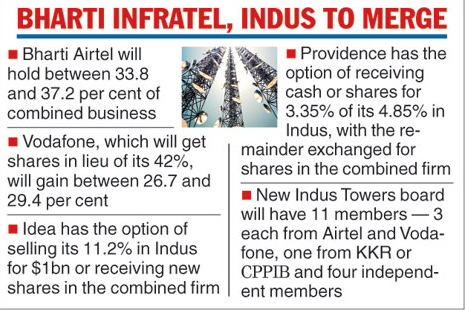

Bharti Airtel will hold between 33.8 per cent and 37.2 per cent of the combined business. Vodafone, which will be issued new shares in exchange for its 42 per cent stake, will hold between 26.7 per cent and 29.4 per cent.

Bharti Airtel shares climbed over 3 per cent on the back of the deal, while the shares of Bharti Infratel lost over 3 per cent on the Bombay Stock Exchange.

Idea has the option of selling its 11.2 per cent stake in Indus for about $1 billion or receiving new shares in the combined firm. Providence has the option to receive cash or shares for 3.35 per cent of its 4.85 percent holding in Indus, with the remainder exchanged for shares in the combined firm.

The new Indus Towers board will have 11 members – three each from Bharti Airtel and Vodafone, one from KKR or Canada Pension Plan Investment Board (CPPIB) as well as four independent members. KKR and CPPIB last year bought a combined stake of more than 10 per cent in Bharti Infratel.

India

India